Benchmarking of 3D printing technologies, granular market forecasts, and complete player analysis

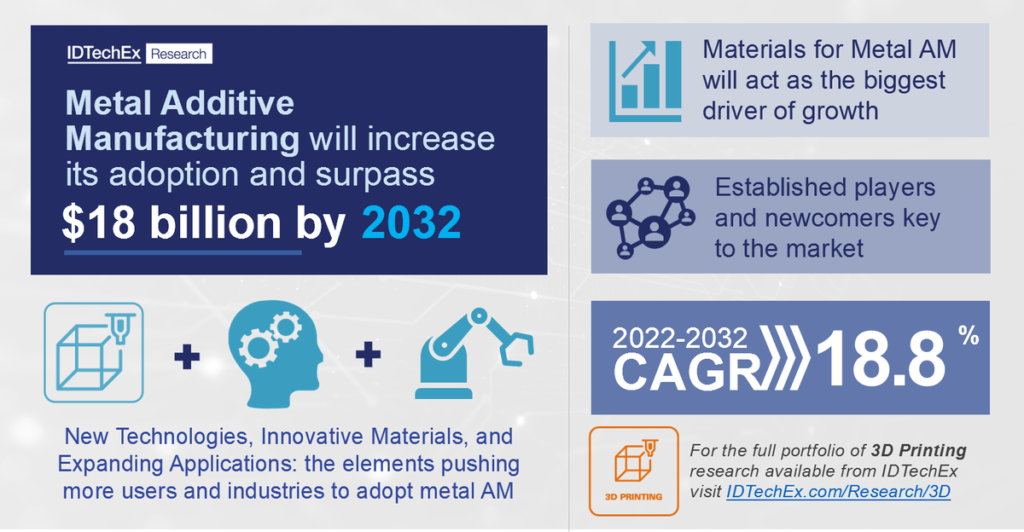

After initial commercialization in the 1990s, metal additive manufacturing (also referred to as 3D printing of metals) has witnessed a flurry of interest in recent years. Key players have been quick to capitalize on this demand, enjoying exponential revenue growth since 2013 as a result.

This comprehensive technical report from IDTechEx gives the detailed status and outlook for the industry. Built upon an extensive history in the market and large number of primary interviews, this report provides an unbiased forecast for the market, including the impact and recovery from the COVID-19 pandemic in the past two years.

Granular forecasts and detailed player profiles

This report provides granular 10-year market forecasts for the industry. The demand for metal printing hardware and metal 3D printing materials in the next decade is quantified. Targeted quantitative analysis is given for printer technologies and materials, broken down into 10 technology segments and 9 materials segments.

These forecasts are generated by the IDTechEx analyst team. The analysts go far beyond what is publicly available by conducting an extensive number of primary interviews, providing the latest and most important information to the reader. Over 75 company profiles are included as part of this report; this includes key OEMs, disruptive start-ups, incumbent powder providers, and emerging material companies.

Benchmarking the competitive printer processes

The proposed advantages to metal additive manufacturing are numerous with design freedom, local versatile manufacturing, potential cost savings, shortened manufacturing times, and much more.

To exploit this there is an ever-expanding family of printer processes using a wide number of material feedstocks. A common tactic for new entrants is to invent new terms for their technology to differentiate from the competition. Some of these are unique but most are aligned with existing processes, introducing only subtle variations.

This report cuts through this marketing and provides accessible impartial categorization for the industry. The reality is that every process must compromise on something, be it the rate, price, precision, size, material compatibility, or more. IDTechEx provide critical benchmarking studies of these processes: an essential process for identifying gaps in the market and end-use applications.

There is also the learning curve to be considered. As with any new (primarily) B2B technology with a large price-tag, it will take time for end-users to have confidence in the process and value-add to warrant the investment. Powder bed fusion processes (DMLS, SLM, and EBM) have been commercial for the longest time, which results in this technology underpinning most installations. However, the next generation of technologies is gaining more traction and within the next decade a more diverse installation base will be observed.

There are some overarching trends for new entrants as they try to find gaps in the market. Low-cost variants, printers pushing the size extremes from micro to very large scales, faster rates, and those exploiting alternative forms of feedstocks are all rapidly emerging and assessed.

Key markets and the impact of COVID-19

Metal additive manufacturing has been used for prototypes, tooling, replacement parts, and small to large manufacturing. There are multiple sectors in which this emerging technology is gaining significant uptake, including oil & gas, jewelry, and building & construction. The growth and adoption have all been in high-value industry verticals and the long-term future looks very optimistic.

That said, the COVID-19 global pandemic rapidly introduced new opportunities and concerns for the industry. One opportunity has arisen from major disruptions in global supply chains, which is new interest in distributed manufacturing operations. As international manufacturers address vulnerabilities in their supply chain, metal additive manufacturing has the potential to position itself as a key component in solving supply chain issues. On the other hand, key markets like aerospace face prolonged recovery from pandemic effects. This report analyzes the many trends and global market factors impacting metal additive manufacturing within the decade.

This market report gives granular forecasts for technologies and materials taking into account the impact of COVID-19.